Car buying tax calculator

If you would like the car buying calculator to calculate the number of hours you will have to work each year to stay current with the costs of ownership enter your real hourly wage in. It is applied before HST and is calculated at 20 of the value above 100k or 10 of the full value of the vehicle whichever is the lesser.

How To Calculate Find The Sales Tax Rate Or Percentage Formula For Calculating Sales Tax Rate Youtube

Applying for a Duplicate Title.

. New residents to Georgia pay TAVT at a rate of 3 New. Use our online sales tax calculator then speak with the auto finance experts at our VW dealer near Marysville WA. Know Your Payment Options While You Shop With No Hit To Your Credit Score.

Ad Shop the Best Deals Near You. Trade-in Value Get a cash value for your car. Use this calculator to help you determine your monthly car loan payment or your car purchase price.

The lowest city tax. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. After you have entered your current information use the graph options to see how.

Information about titling and registering a motor vehicle trailer boatvessel or all-terrain vehicle. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in the state. If you buy the vehicle from a licensed dealer the tax is 625 of the sales price.

Cars Trucks and SUVs. That means if you purchase a vehicle in Missouri you will have to pay a minimum of 4225. Youll find great deals on amazing cars and phenomenal tax savings.

Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. Choose a Highly Rated Salesperson. How much tax is due.

Lets take an example. Earnings of more than 4189 a month are subject to national insurance at a rate of 325 instead of 2. Estimate your monthly car payment with our payment calculator and explore vehicle financing.

Even if you purchased your new car in a different state you will pay sales tax for the state where you. Estimate Tax Calculation For Buying A Used Motor Vehicle. Estimated tax title and fees are 1000 Monthly payment is 405 Term Length is 72 months.

If you buy from a private. Find out the auto sales tax rate specific to your state and city. Ad Calculate Your Monthly Car Loan Payments With Tax And See Which Cars Fit Your Budget.

If the sales tax in your state is 575 which also happens to be the national average then multiply 575 by the amount and then divide it by 100. 575 of 10000 is 575. Employers contribution jumped from 138 to 1505.

Lets say you are buying a used. GR86 Price Based on Trim Look up vehicle price. Ad Find Car Price Tax Calculator.

The current state sales tax on car purchases in Missouri is a flat rate of 4225.

How To Calculate Sales Tax In Excel

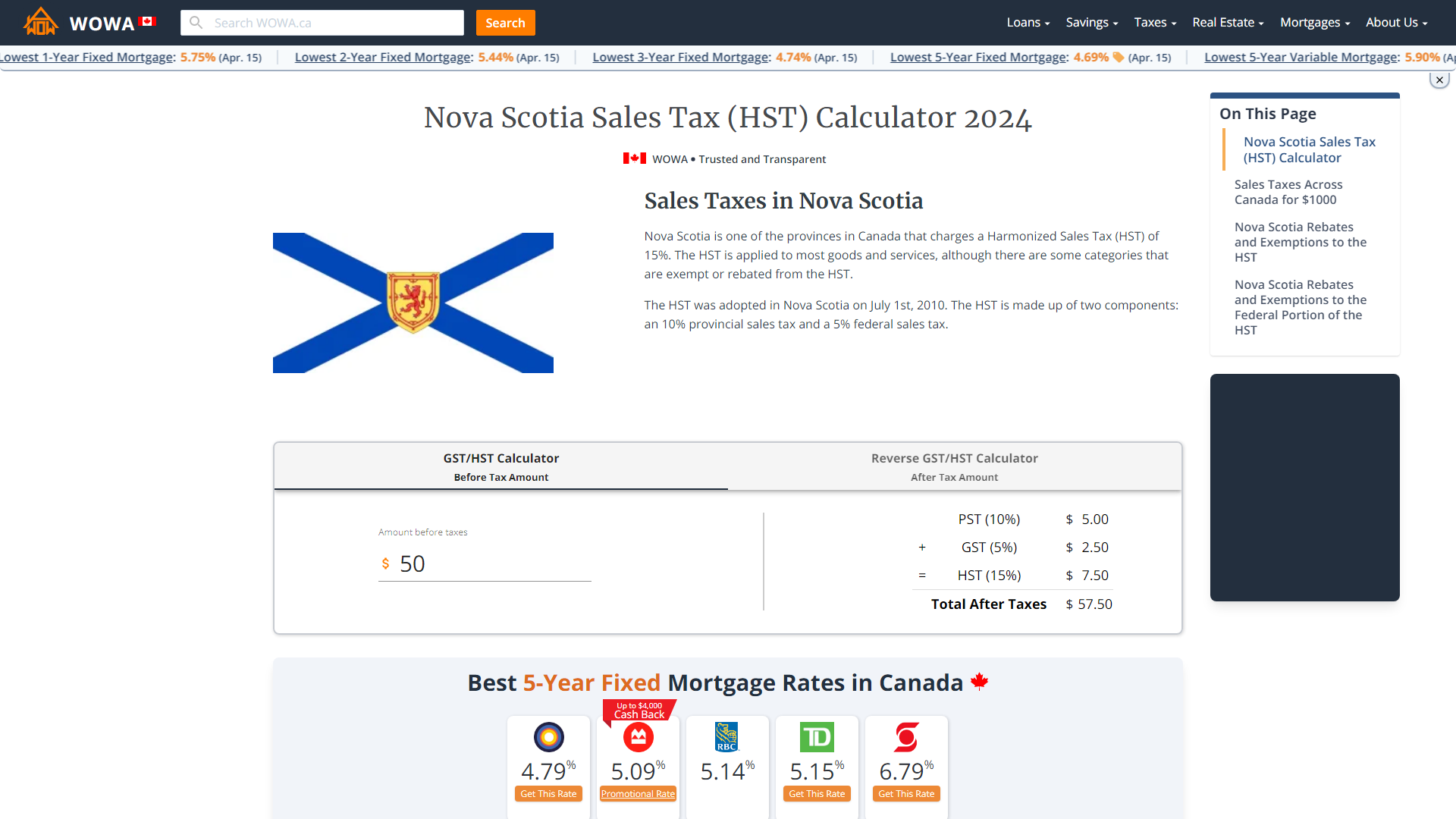

Nova Scotia Sales Tax Hst Calculator 2022 Wowa Ca

Reverse Sales Tax Calculator

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax In Excel

Car Tax By State Usa Manual Car Sales Tax Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Sales Tax Calculator

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Yqme50hpmtgn8m

Property Tax Calculator

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How To Calculate Sales Tax In Excel

Komentar

Posting Komentar